The Lasting Financial Impact of Redlining on Communities of Color

The financial impact of systemic racism, particularly through historical redlining policies, continues to depress housing values, limit access to credit, and hinder wealth accumulation in communities of color across the United States today.

The echoes of discriminatory practices like redlining still reverberate through American society, profoundly shaping the financial landscape of many communities today. The financial impact of systemic racism: How redlining policies from the past still affect communities today, creating disparities that persist across generations.

Understanding Redlining: A Legacy of Discrimination

Redlining, a discriminatory practice prevalent in the mid-20th century, involved denying services, particularly mortgage loans, to residents of specific neighborhoods based on race or ethnicity. This governmental policy was a clear expression of systemic racism, with long lasting implications for the financial well-being of communities.

This practice has had significant repercussions on economic and social mobility. By understanding its origins and impact, we can begin to tackle the challenges it presents. Keep reading as we discuss how redlining policies from the past still affect communities today.

The Origins of Redlining

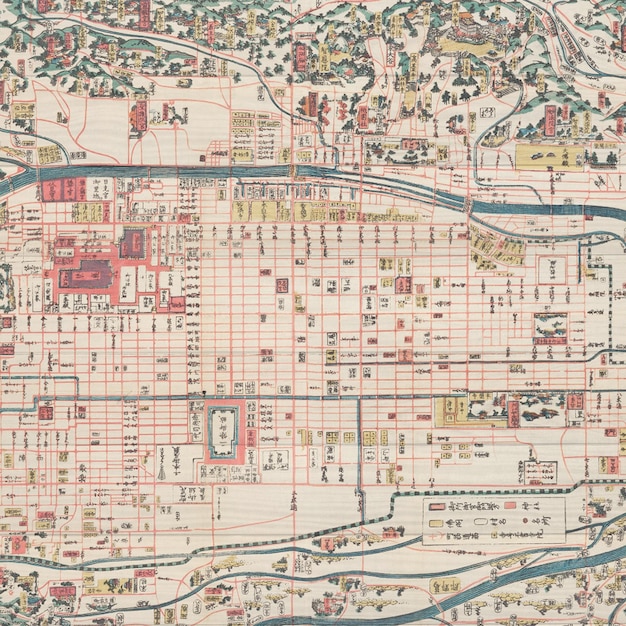

- Home Owners’ Loan Corporation (HOLC): Created in 1933, HOLC drew maps assigning risk grades to neighborhoods.

- Racial Composition: Neighborhoods with African American residents or other minority groups were typically graded “hazardous” and outlined in red—hence the term “redlining.”

- Impact on Lending: These grades influenced lending decisions, making it nearly impossible for residents in redlined areas to obtain mortgages.

The Consequences of Redlining

The deliberate denial of property investment and loans that characterized redlining caused long-lasting impacts in communities affected by this practice.

- Depressed Property Values: Redlining led to a decline in property values in affected areas, as residents could not obtain loans to improve or maintain their homes.

- Limited Access to Credit: The lack of access to credit made it difficult for residents to start businesses or invest in their communities.

- Concentrated Poverty: Redlining contributed to the concentration of poverty in specific neighborhoods, perpetuating cycles of disadvantage.

By purposefully limiting a wide range of economic options, previously redlined communities were severely impacted by the practice itself, losing out on crucial opportunities to thrive and grow like surrounding areas. Therefore, redlining caused several decades worth of negative impacts that exist even today.

The Persistence of Economic Disparities

Although redlining was outlawed by the Fair Housing Act of 1968, its effects are still evident in economic disparities across many U.S. cities. Many of the neighborhoods that were redlined continue to suffer from disinvestment and economic disadvantage.

These current disparities are related to decades of lost capital which have translated into the loss of opportunities for home ownership, business creation and other means to financial stability. Let’s examine some of these economic impacts.

Wealth Accumulation

Homeownership is a significant driver of wealth accumulation in the United States. Because redlining restricted homeownership opportunities for minority families, it hindered their ability to build wealth.

- Generational Wealth: The inability to acquire property prevented families from passing down wealth to future generations.

- Savings and Investments: Without home equity, families had fewer resources to invest in education, healthcare, or retirement savings.

- Business Opportunities: Home equity is often used as collateral for small business loans, further limiting entrepreneurial opportunities.

Healthcare Disparities

The financial impact of redlining extends to healthcare, as redlined neighborhoods often lack adequate access to medical facilities and resources. Residents may face challenges in accessing quality care, leading to poorer health outcomes.

Additionally, environmental hazards such as pollution and toxic waste sites are disproportionately located in previously redlined areas. Environmental factors can greatly impact the overall health and well being of community members.

When communities are subjected to these kinds of environmental and healthcare disparities, wealth accumulation and social advancement are much more difficult to achieve. Communities affected by these ailments lose work days, face expensive medical bills and encounter overall reduced qualities of life.

The Connection between Redlining and Health

As mentioned before, poverty and reduced access to resources has greatly impacted the health situations of many residents from previously redlined neighborhoods.

- Limited Access to Resources: The systemic lack of resources also impacts the availability of healthy foods, leading to poor nutrition and health outcomes.

- Environmental Factors: Pollution and environmental hazards in these areas contribute to respiratory illnesses and other health problems.

- Stress and Mental Health: Living in economically distressed neighborhoods can increase stress levels and negatively affect mental health.

Communities experiencing these types of health and environmental factors face many challenges associated with long-term exposure to these issues. A combination of increased health problems and lack of capital can make thriving communities nearly impossible.

Education Inequality

Redlining also affected the quality of education available in redlined neighborhoods. Public schools in these areas often received less funding, resulting in inadequate resources and poorer educational outcomes. The impact of this inequity on economic opportunity is staggering.

Children who grow up in poverty and attend struggling local schools, encounter several factors limiting their potential. These students find it much more difficult to succeed in school and break out of these negative cycles.

The School Funding Disparity

- Local Property Taxes: Public schools are often funded through local property taxes, so redlined neighborhoods with lower property values receive less funding.

- Teacher Quality: Lower salaries and limited resources make it difficult to attract and retain qualified teachers in these schools.

- Educational Resources: These schools often lack access to essential resources such as technology, libraries, and extracurricular activities.

These education disparities continue to create wealth gaps by contributing towards the lack of human capital in previously redlined communities.

These discrepancies cause students in these areas to fall further behind in the long run, greatly diminishing their future opportunities.

Strategies for Addressing the Legacy of Redlining

Addressing the financial impact of systemic racism and redlining requires a multifaceted approach involving government policies, community initiatives, and private sector investments. It is important to employ effective strategies that address these wealth and opportunity gaps effectively. The following strategies are some examples.

Policy Reforms

- Fair Housing Enforcement: Strengthening enforcement of fair housing laws to prevent modern-day discrimination in housing and lending.

- Community Reinvestment Act (CRA): Encouraging banks to invest in low- and moderate-income communities.

- Targeted Investments: Directing government funding towards revitalization projects in previously redlined neighborhoods.

Community-Led Initiatives

Empowering residents in previously redlined neighborhoods allows them to grow from within by being more involved in initiatives created by local community leaders.

- Financial Literacy Programs: Providing education and resources to help residents manage their finances and build wealth.

- Affordable Housing Development: Creating affordable housing options to increase homeownership opportunities.

- Small Business Support: Offering resources and support to entrepreneurs looking to start or expand businesses in these areas.

Collaboration and Investment

A true team effort of collaborative investment is necessary to start repairing the economic damage from these prior systemic oppressions

- Public-Private Partnerships: Encouraging collaboration between government agencies, private companies, and community organizations.

- Impact Investing: Directing investment capital towards projects that generate both financial returns and positive social impact.

By purposefully directing funding to these communities, businesses and residents in affected areas are better served. This creates economic opportunities and helps bridge the gaps created by practices such as redlining

The Role of Technology in Overcoming Disparities

Technology can play a significant role in addressing the financial impact of redlining by increasing access to information, resources, and opportunities. Online platforms can connect residents with affordable housing options, financial education programs, and job opportunities. In addition, technology can help to monitor and address discriminatory practices in housing and lending.

Technology also provides businesses with the tools to grow and thrive in a digital world. When businesses in affected areas develop stronger digital toolsets, they become more profitable and attractive, which strengthens communities as a whole.

Data-Driven Solutions

- Algorithmic Fairness: Developing algorithms that are free from bias and do not perpetuate discriminatory lending practices.

- Online Education: Creating online platforms offering financial literacy courses and resources.

- Digital Inclusion: Bridging the digital divide by providing access to technology and internet connectivity in underserved communities.

By promoting open and honest data and focusing on making communities more competitive with internet technology, the wealth gaps can start to steadily close over time through an effective deployment of time and capital.

| Key Point | Brief Description |

|---|---|

| 🏡 Redlining Impact | Historical redlining depressed property values, limited credit access, and hindered investment in communities of color. |

| 💰 Wealth Accumulation | Redlining restricted homeownership, preventing minority families from building generational wealth. |

| 🏥 Healthcare Access | Redlined areas often lack healthcare resources, leading to poor health outcomes and environmental hazards. |

| 📚 Education Opportunities | Schools in redlined neighborhoods receive less funding, affecting educational quality and future opportunities. |

FAQ: Understanding Redlining’s Lasting Impact

▼

Redlining was a discriminatory practice where services, like loans and insurance, were denied to residents based on their race or ethnicity, primarily in specific neighborhoods, particularly those with large minority populations.

▼

Redlining limited homeownership opportunities for minority families, preventing them from building wealth through property ownership and passing down assets to future generations.

▼

Technology can promote algorithmic fairness, enabling equal access to resources, financial tools, and opportunities for those in previously redlined neighborhoods.

▼

Yes, the Community Reinvestment Act requires banks to invest in low- and moderate-income communities. This investment can improve housing, small business, and local economies.

▼

Community-led initiatives include financial literacy programs, affordable housing development, and support for local entrepreneurs. These initiatives help empower residents and address the economic consequences.

Conclusion

The financial impact of systemic racism: How redlining policies from the past still affect communities today still casts a long shadow over many communities. By understanding its origins, consequences, and opportunities, we can work towards creating a more equitable and just society for all through policy reformation, community initiatives, and technological innovations to facilitate a more just system.